Seamlessly Add Payment Facilitation

Seamlessly Add Payment Facilitation

The Payfactory Platform

Payment facilitation is the future of payment processing. Merchants want a no-hassle application and payment acceptance experience. ISVs want to satisfy their customers and source additional income without the overhead costs and development of typical payment integrations. Payfactory’s payment facilitation platform provides seamless, embedded payments for both merchants and ISVs.

Fast merchant approval, automated onboarding, next day funding

Vertical specific underwriting

Transaction and settlement reporting

Self-serve merchant and partner portals

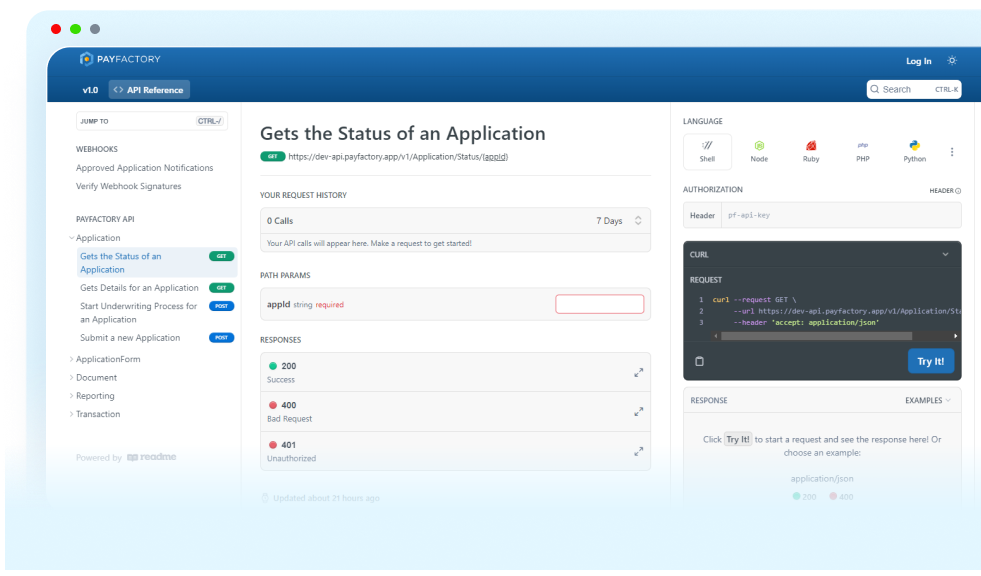

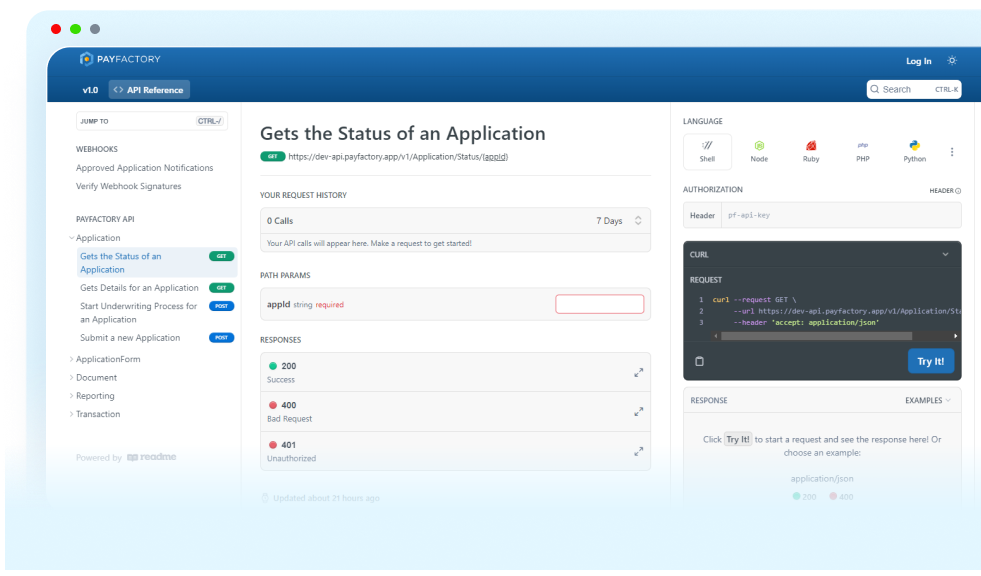

Low to no development; available API’s and webhooks

Split payments, surcharge and convenience fees*

PCI compliance, encryption and tokenization

Chargeback and fraud monitoring, 3D Secure

Fast merchant approval, automated onboarding, next day funding

Vertical specific underwriting

Transaction and settlement reporting

Self-serve merchant and partner portals

Low to no development; available API’s and webhooks

Split payments, surcharge and convenience fees*

PCI compliance, encryption and tokenization

Chargeback and fraud monitoring, 3D Secure

Cardholder Paying With Credit Card

Item Cost

Platform Fee

Card Processing Bank

Item Cost deposited to Merchant Account

How it Works

Payfactory

Revenue Shared with Partner/ISV (Monthly)

Cardholder Paying With Credit Card

Item Cost

Platform Fee

Card Processing Bank

Item Cost deposited to Merchant Account

Payfactory

Revenue Shared with Partner/ISV (Monthly)

How it Works

Cardholder Paying With Credit Card

Item Cost

Platform Fee

Card Processing Bank

Item Cost deposited to Merchant Account

Payfactory

Revenue Shared with Partner/ISV (Monthly)

How it Works

How it Works

Our payfac platform is easily added to your current payments flow, regardless of provider or processor.

Our Core Focus

Security

Payfactory provides the highest level of security for payment transactions with PCI-validated point-to-point encryption (P2PE) or standard end-to-end encryption for card data transmission and state-of-the-art tokenization for stored and recurring payments.

Service

Our range of modular and portable payment facilitation service options enable ISVs and software companies to customize and control the payfac experience while eliminating the time and expense of building in-house infrastructure.

Support

Payfactory runs the payments back office, taking care of risk, underwriting, funding, PCI compliance and payment and data security. We are your white-glove payments partner, providing direct support to partners, from integration to go-live.

Payfac vs. Traditional Payment Processing

There are many embedded payment options available, but what’s the difference between traditional payment processing and payment facilitation? Check out our frequently asked questions to learn about the benefits of Payfactory’s payfac platform, from immediate merchant approval to next day funding to split payments.

Embed Payments Today

Ready to start embedding payments into your ISV or SaaS platform?

Contact us to get started.